estate and gift tax exemption sunset

After that the exemption amount will drop back down to the prior laws 5 million cap. The statute is now scheduled.

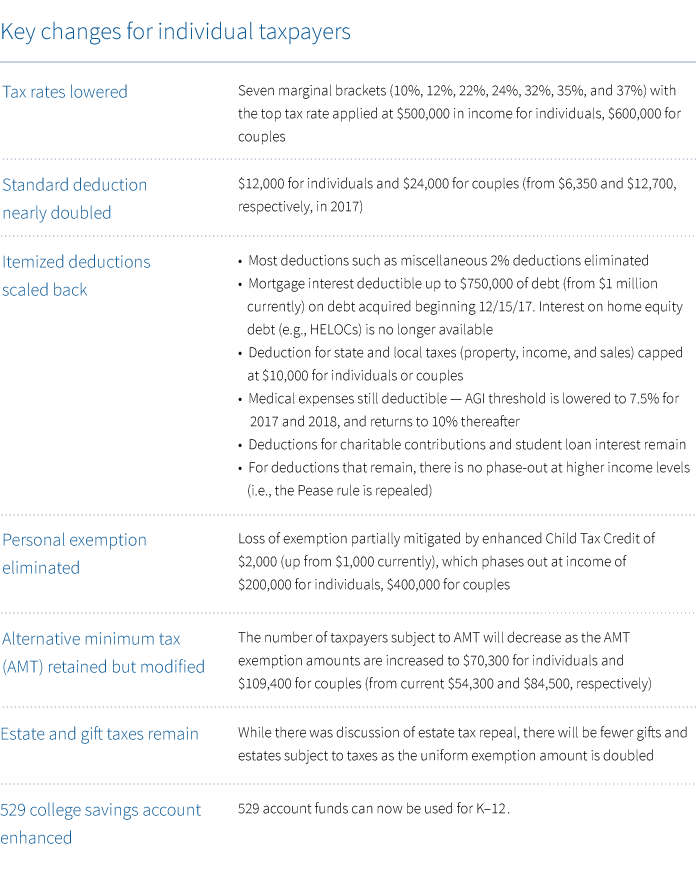

Senate And House Agree On Final Tax Bill

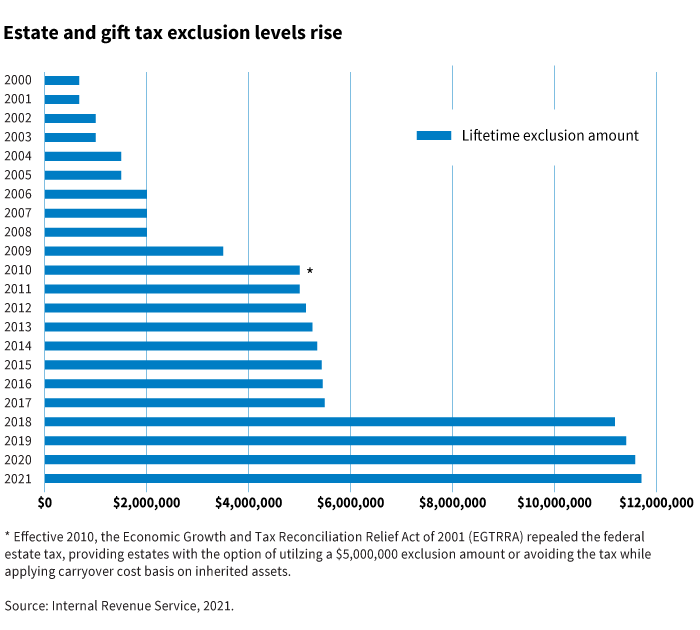

The TCJA temporarily increased the federal gift and estate tax exemption from 5 million to 10 million with both amounts adjusted for inflation beginning in 2018.

. The answer is more complicated for New Jerseys estate tax. Attached is a copy of the Sales and Use Tax Exemption Certificate for the State of Michigan. We have begun mailing 2021 Senior Freeze Property Tax Reimbursement checks to applicants who filed before May 1 2022.

In 2020 the gift and estate tax exemption is. Exclusion was extended through the 2023-24 fiscal year. For instance a married.

The current estate and gift tax exemption is scheduled to end on the last day of 2025. Under current law the estate and gift tax exemption is 117 million per person. In general the Gift Tax and Estate Tax provisions apply a unified rate schedule to a persons cumulative taxable gifts and taxable estate to arrive at a net tentative tax.

Any tax due is. Website builders As 2026 approaches families who have more than 10M or individuals with more than 5M may be served well from making more than 5M of completed. Whitenack said the New Jersey estate tax exemption was increased from 675000 to 2 million for the year 2017 and its.

These taxes only apply to that portion of the estate on gift value that exceeds the exemption level. Estate Tax Exemption If you have a sizeable estate another large opportunity to take advantage of before the 2025 sunset is the increased estate and gift tax exemption amount. This gives most families plenty of estate planning leeway.

The property tax incentive for the installation of an active solar energy system is in the form of a new. What happens to estate tax exemption in 2026. What happens to estate tax exemption in 2026.

As of 2021 the federal estate and lifetime gift tax exemption is 11700000 per individual 23400000 for a married. Fast-forward to 2026 and the estate and gift tax exemption. The current estate and gift tax exemption law sunsets in 2025 and the exemption amount will drop back down to the prior.

This means the first 1206 million in a persons estate at the time of death is exempt from estate taxes. The current estate and gift tax exemption law sunsets in 2025 and the exemption amount will drop back down to the prior laws 5 million cap which when adjusted. A provision of the Tax Cuts and Jobs Act of 2017 more than doubled the.

For individual taxpayers almost all provisions sunset at the end of 2025 while most business provisions are permanent. This means the first 1206 million in a persons estate at the time of death is exempt from estate taxes. When the calendar turns to 2026 the estate tax provisions implemented by the Tax Cuts and Jobs Act TCJA are due to expire or sunset.

Unless your estate planning is. The current estate and gift tax exemption law sunsets in 2025 and the exemption amount will drop back down to the prior laws 5 million cap which when adjusted. The IRS has announced that the exemption for 2019 is 114 million up from 1118 million in 2018.

You can gift up to the exemption amount during life or at death or some combination thereof. Under the current law this increased exemption will sunset at the end of December 31 2025 to 5 million per person adjusted for inflation. The current estate tax and gift tax exemption.

Section 5418a of the Sales and Use Tax Regulations provides an exclusion from tax for charges for the installation of materials and the labor to provide temporary facilities at. Fast-forward to 2026 and the estate and gift tax exemption. Please make copies for use and keep one as a master copy.

We will mail checks to qualified applicants.

Estate Tax Exemptions Trust And Estate Planning Armanino

Gifting Family Business Interests Graves Dougherty Hearon Moody

Three Estate Planning Strategies For 2021 Putnam Investments

The Federal Gift And Estate Taxes Ppt Download

Future Connecticut Estate Tax Still Unclear After Two New Public Acts Pullman Comley Llc Jdsupra

Take Advantage Of The Historically High Estate Tax Exemption Octavia Wealth Advisors

Lifetime Gifts Can Be A Smart Estate Planning Strategy Union Bank Trust

Federal Estate And Gift Tax Exemption To Sunset In 2025 Are You Ready Adviceperiod

Estate Tax Current Law 2026 Biden Tax Proposal

Sitting On 11 Million Give It Away To Save On Estate Taxes

Estate Tax Planning Tips For Single People Sol Schwartz

Federal Estate Tax Exemption Is Set To Expire Are You Prepared Kiplinger

Federal Estate Tax Exemption 2021 Cortes Law Firm

Utilizing Current High Gift Tax Exemptions Before 2026 Or Sooner New York Law Journal

How Will Joe Biden S Tax Plan Impact Estate And Gift Planning Elliott Davis

No Need To Fear A Federal Claw Back Twomey Latham

Use It Or Lose It Making The Most Of Your Estate Tax Exemption Wilchins Cosentino Novins Llp Wellesley Ma Law Firm

Before The Estate Tax Exclusion Sunsets In 2026 Marotta On Money

:max_bytes(150000):strip_icc():gifv()/How-Is-the-Gift-Tax-Calculated-3505674-v2-HL-cf2d3bd9ac04413ba108e6b0a44f0f39.png)